Back to the news list

Back to the news list

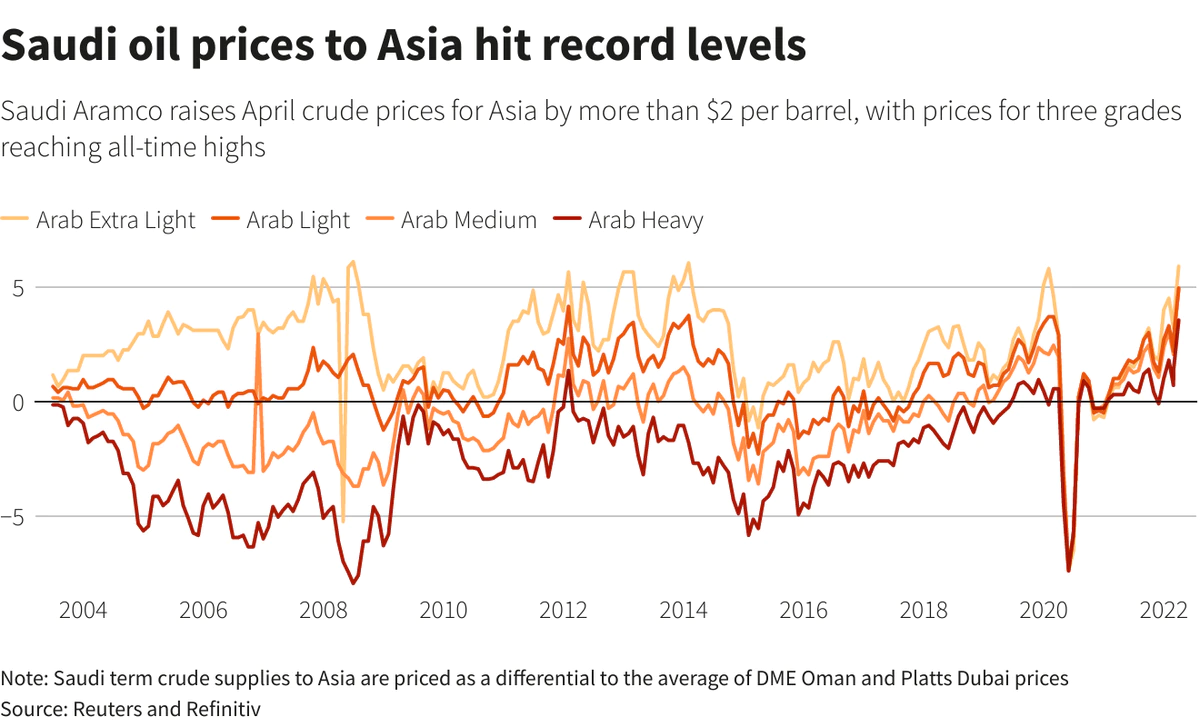

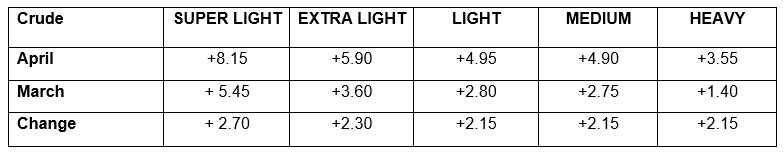

Saudi Arabia’s state oil producer Aramco raised the April official selling prices (OSPs) for crude it sells to Asia by more than $2 a barrel, with some grades hitting all-time highs, as global markets struggled with Russian oil disruption.

A 3D printed natural gas pipeline is placed in front of displayed Saudi Aramco logo in this illustration taken February 8, 2022

Record Saudi crude prices come on the back of an expected rise in Middle East oil demand as surging spot premiums and freight rates put supplies from Europe, Africa and the Americas out of Asia’s reach.

Global oil prices have soared to their highest since 2008, adding to inflation concerns, as the United States and the European explore banning imports of Russian oil in the wake of Moscow’s invasion of Ukraine. Russia calls its actions in Ukraine a “special operation”.

The world’s top oil exporter lifted its April OSP to Asia for its flagship Arab Light crude to $4.95 a barrel versus the average of DME Oman and Platts Dubai crude prices, up $2.15 from March, Saudi Aramco said late on Friday, March 11.

This is the highest premium for the grade ever, Refinitiv data showed. The April OSPs for Arab Medium and Arab Heavy crude in Asia are also all-time highs.

“The prices are higher than expected, but (I) can understand Saudi’s mindset,” a trader said, adding that prices of rival grades such as Abu Dhabi’s Murban crude were also at record levels.

The spot premium for Murban crude futures to Dubai quotes hit a record of nearly $18 a barrel last week while premiums for other benchmark grades such as DME Oman and Dubai were at all-time highs of $15 a barrel.

Saudi term crude supplies to Asia are priced as a differential to the Oman/Dubai average

Separately, Saudi Aramco set the Arab Light OSP to Northwestern Europe at plus $1.60 per barrel versus ICE Brent, an increase of $1.70 compared with March and to the United States at plus $3.45 per barrel over ASCI (Argus Sour Crude Index), an increase of $1 over the previous month.

Không thể sao chép