Back to the news list

Back to the news list

Source: Rigzone & Vietnambiz

Oil slips as rally starts to cool

Oil slipped after hitting $70 a barrel in New York for the first time since October 2018 as a rally driven by signs of a tightening market eased.

Futures jumped 5% last week and were unable to break above the $70 marker Monday, June 7th. The long-term demand outlook remains bullish as vaccination rates climb worldwide, driving greater mobility. OPEC+ appears in control of crude prices, with U.S. production still below pre-pandemic levels, said Mike Muller, Vitol Group’s head of Asia.

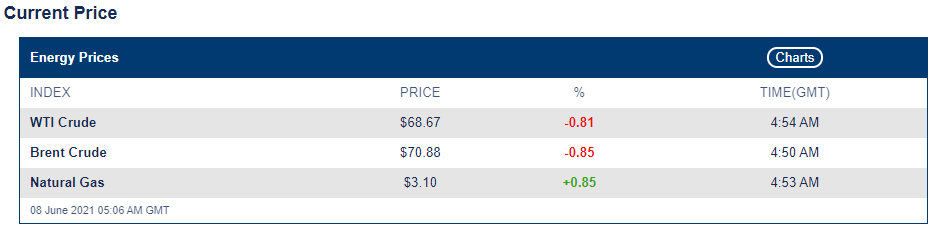

Current prize

A robust rebound from the virus in the U.S., China and Europe has driven prices more than 40% higher this year. But the demand recovery has been patchy with the pandemic still surging in parts of Asia. Chinese oil imports, a major reason behind the rally, fell to a five-month low in May as private refiners held back on purchases amid scrutiny of government-issued purchases quotas.

Light Crude oil

Crude rose by the most since mid-April last week, helped along as Iran and western powers failed to find an deal that would end U.S. sanctions on the Persian Gulf nation’s oil. America said there could be several more rounds of talks about rejoining a 2015 nuclear accord, delaying any quick return of Iranian crude supply to the market.

Brent Crude oil

Prices

The decline in U.S. drilling and output makes OPEC+’s job of managing markets easier, Vitol’s Muller said at a conference on Sunday. Given delays in talks between Tehran and world powers on reviving a nuclear deal, it’s less likely that additional Iranian supply will hit the market before the fourth quarter.

Natural Gas

In the domestic market

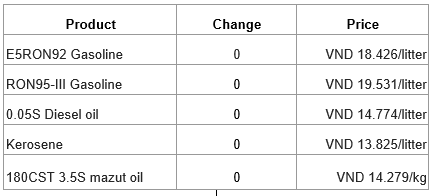

The Inter-Ministry of MoIT and MoF have been keeping the current petroleum products price unchanged since the adjustment period on the afternoon of May 27th.

Accordingly, after using the Petroleum Price Stabilization Fund (PSF), the selling prices of popular petroleum products in the market are as follows:

Domestic market

Không thể sao chép